Daily compound interest formula

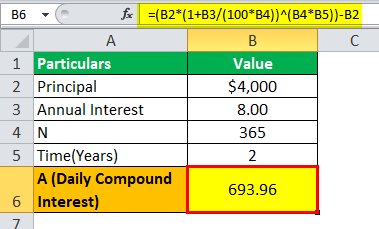

Compound interest P 1rn nt - P. A sum of 4000 is borrowed from the bank where the interest rate is 8 and the amount is borrowed for two years.

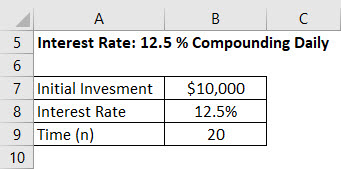

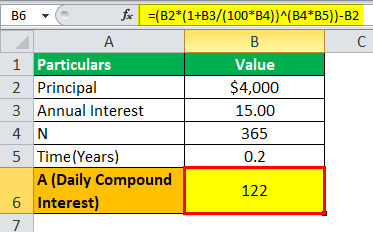

Daily Compound Interest Formula Calculator Excel Template

As mentioned above compound interest has many applications in real-life.

. Plus you can also program a daily compound interest calculator Excel formula for offline use. Use of a continuous compound interest calculator is among the various benefits of this strategy is the fact that it allows you to visualize investment horizons. The basic formula for compound interest is as follows.

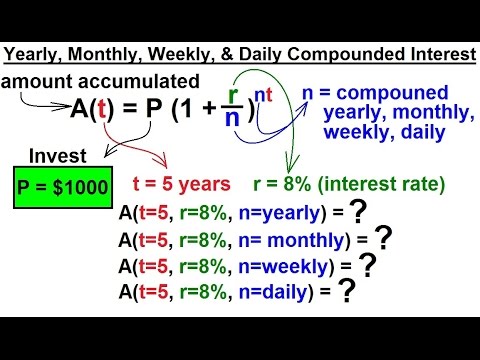

Before we discuss the daily compound interest calculator in Excel we should know the basic compound interest formula. A t A 0 1 r n. Compound Interest Explanation.

Relevance and Uses of Daily Compound Interest Formula. The initial investment interest rate duration and the formula are exactly the same as in the above example only the compounding period is different. If your local bank offers a savings account with daily compounding 365 times per year what annual interest rate do you need to get to match the rate of return in your investment account.

Thought to have. Say you have an investment account that increased from 30000 to 33000 over 30 months. R is the annual interest rate.

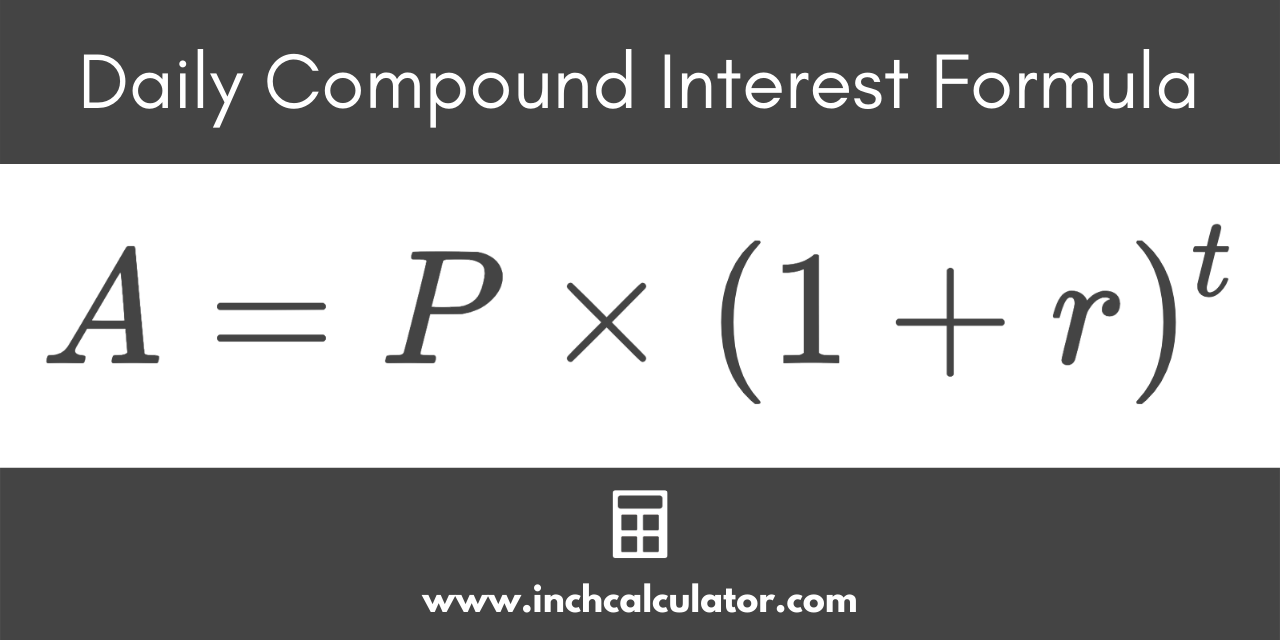

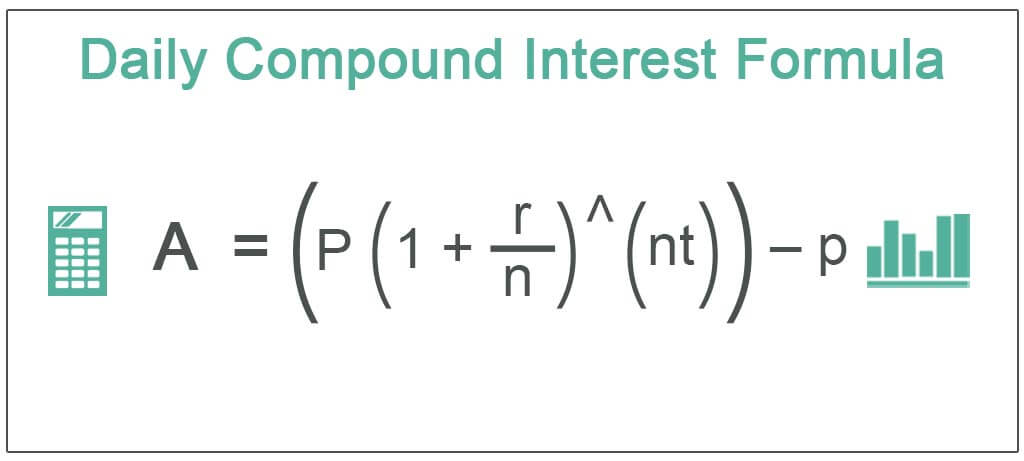

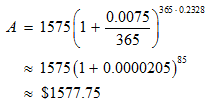

The general formula for simple interest is. Using the formula above depositors can apply that daily interest rate to calculate the following total account value after two years. Daily compound interest is calculated using a simplified version of the formula for compound interest.

Next raise that figure to the power of the number of days it will be compounded for. To begin your calculation take your daily interest rate and add 1 to it. Interest principal rate term So using cell references we have.

To compute compound interest we need to follow the below steps. For example say you have 100 in a savings account and it earns interest at a 10 rate compounded annually. Daily Compound Interest Simple.

Calculate interest compounding annually for year one. At the end of the first year youd have 110 100 in principal 10 in interest. Compound Annual Growth Rate - CAGR.

The Principle of Compound Interest. Daily Compound Interest Formula in Excel. The compound annual growth rate CAGR is the mean annual growth rate of an investment over a specified period of time longer than one year.

How to calculate daily compound interest. This compounding interest calculator shows how compounding can boost your savings over time. The FV function can calculate compound interest and return the future value of an investment.

If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. Subtract the initial balance if you want to know the total interest earned. You can calculate based on daily monthly or yearly compounding.

How to Use the Compound Interest Calculator. Daily Compound Interest Daily Compound Interest Daily Compound Interest refers to the total interest. Treasury savings bonds pay out interest each year based on their interest rate and current value.

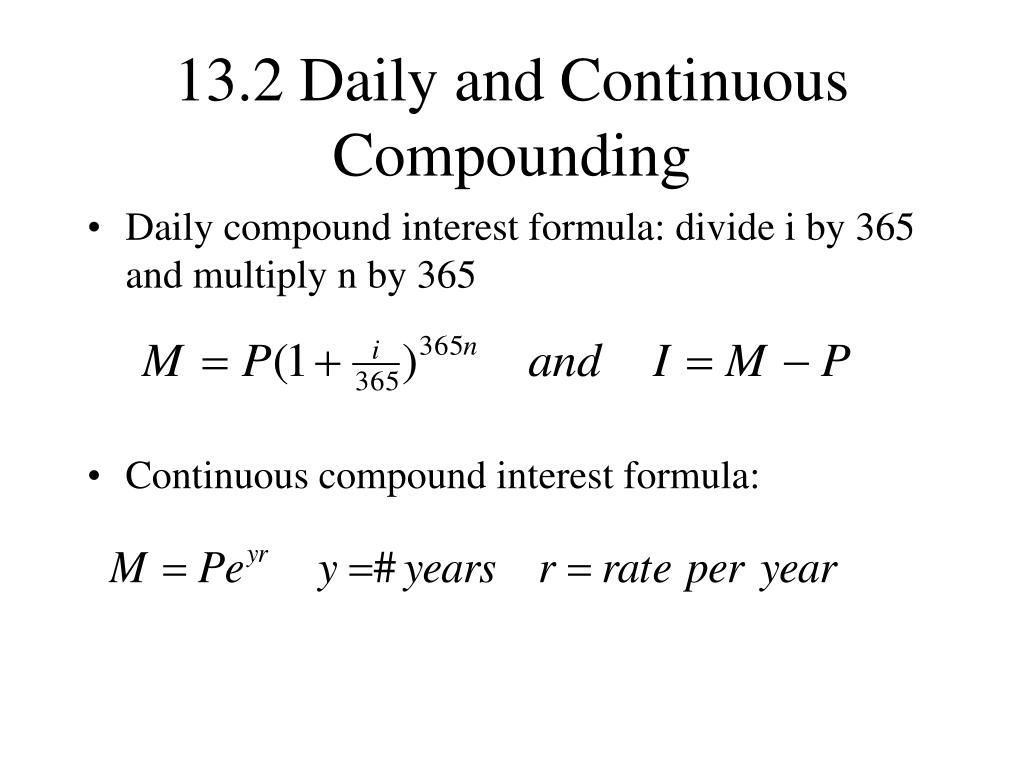

The formula for the Compound Interest is. The daily compound interest formula is given as A P 1 r 365 365 t where P is the principal amount r is the interest rate of interest in decimal form n 365 it means that the amount compounded 365 times in a year and t is the time. Principal amount or initial investment A t.

Daily compound interest formula. Compounded annual growth rate ie CAGR is used mostly for financial applications where single growth for a period needs to be calculated. You can find many of these calculators online.

The basic compound interest formula is shown below. In simple interest you earn interest on the same principal for the investment term and you lose out on income that you can earn on that additional amount. The essential factors of calculating compound interest are principal interest rate and frequency of compounding in a given duration.

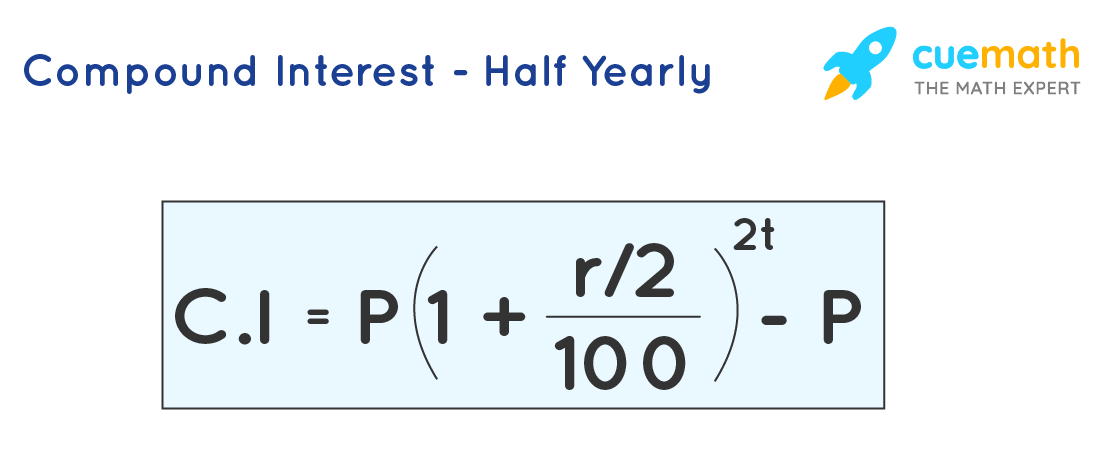

Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. Compound interest is calculated using the compound interest formula. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan.

Interest paid in year 1 would be 60 1000 multiplied by 6 60. I hope the monthly compound interest example is well understood and now you can use the same approach for daily compounding. If you are saving up for a big goal such as a vacation or to pay for college expenses compounding can help you reach your goals faster.

Exams Daily Indias no 1 Education Portal. Here we will discuss maths compound interest questions with solutions and formulas in detail. Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and.

The calculation formula is. C5 C7 C6 1000 10 005 500. Compound Interest Solved Examples.

Daily compound interest formula. P is principal or the original deposit in bank account. Compounding as a whole help earn interest on interest which makes logical sense.

Compound Interest Calculator Compounding daily Interest can be your best friend or your worst enemy depending on which side of the lending you are on. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. T is the number of years.

Let us solve various examples based on these applications to understand the concept in a better manner. Assume that you own a 1000 6 savings bond issued by the US Treasury. A t 365 2 A t.

Amount after time t. Find out the initial principal amount that is required to be invested. These days financial bodies like banks use the Compound interest formula to calculate interest.

Compound Interest Calculator. Current Balance Present Amount. To configure the function we need to provide a rate the number of.

Money is said to be lent at compound interest when at the end of a year or other fixed period the interest that has become due is not paid to the lender but is added to the sum lent and the amount thus obtained becomes the principal in the next year or period. Let us determine how much will be daily compounded interest calculated by the bank on loan provided. If you have 100 and the simple.

In simple words the compound interest is the interest that adds back to the principal sum so that interest is earned during the next compounding period.

Business Math Finance Math 5 Of 30 Compound Interest Daily Compounding Youtube

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Calculator Inch Calculator

Compound Interest Formulas Derivation Solved Examples

Daily Compound Interest Formula Step By Step Examples Calculation

Learn Daily Compound Interest Formula In Commercial Math

Precalculus Exponential Function 6 Of 13 Yearly Monthly Weekly Daily Compounded Interest Youtube

Compound Interest Formula With Calculator

Compounded Daily Clearance 50 Off Www Wtashows Com

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Formula Step By Step Examples Calculation

What Is The Mathematical Formula For Interest That S Compounded Daily Quora

Compound Interest Definition Formula How It S Calculated

Compounded Daily Clearance 50 Off Www Wtashows Com

Calculate The Daily Compounding Interest Of A 1575 Loan

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Daily Compound Interest Formula Step By Step Examples Calculation